mississippi state income tax rate 2020

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. First gauge if you need to file a state income tax return in the state.

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Start filing your tax return now.

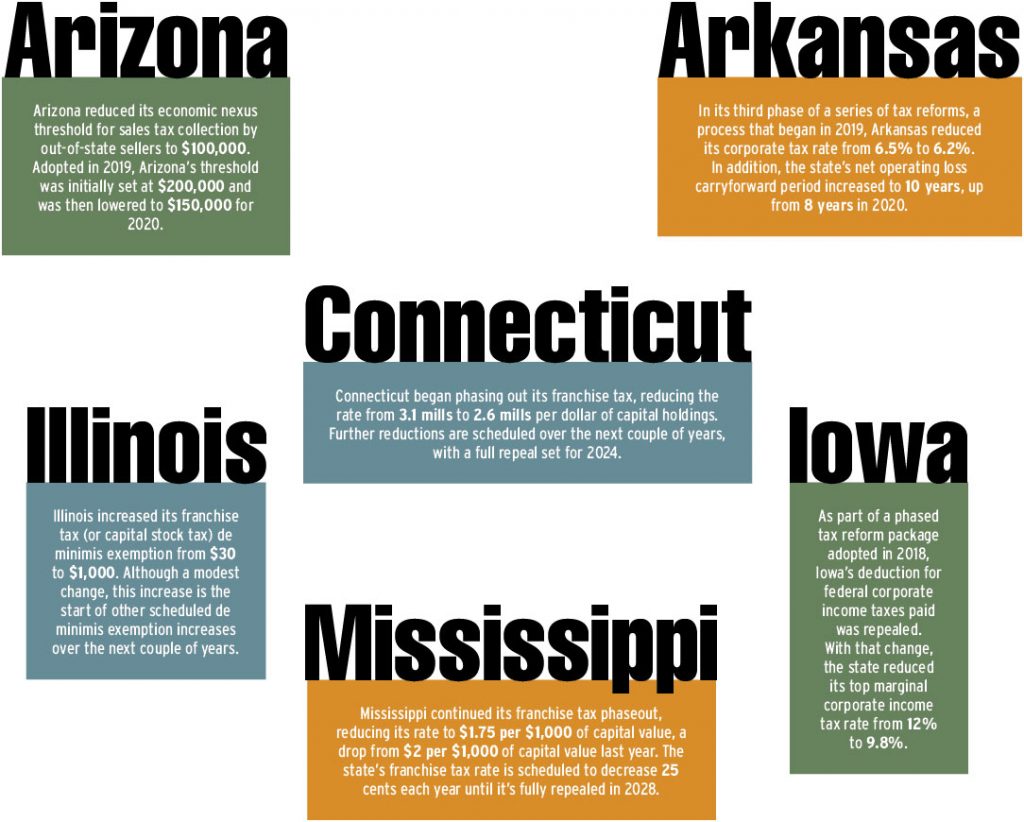

. If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results. Explore data on Mississippi s income tax sales tax gas tax property tax and business taxes. Connecticut plans to phase out its tax by January 1 2024.

Sources of State and Local Tax. A list of Income Tax Brackets and Rates By Which You Income is Calculated. Box 23050 Jackson MS 39225-3050.

Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. 5 on all taxable income over 10000. Detailed Mississippi state income tax rates and brackets are available on this page.

14 hours agoMississippis Republican-controlled legislature passed legislation in 2022 that will eliminate the states 4 income tax bracket starting in 2023. States with the highest capital stock tax rates include Arkansas 030 percent Louisiana 0275 percent. This means that these brackets applied to all income earned in.

If you are receiving a refund PO. 4 on the next 5000 of taxable income. Corporate and partnership income tax.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. TAX DAY IS APRIL. 0 on the first 4000 of taxable income.

In the following three years the. Learn about Mississippi tax rates rankings and more. Because the income threshold for the top bracket is quite low.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. Mississippi Income Tax Rate 2022 - 2023. 3 on the next 1000 of taxable income.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4. Box 23058 Jackson MS 39225-3058.

All other income tax returns P. The graduated income tax rate is. Detailed Information about Mississippi state income tax brackets and rates standard deduction.

Marginal Corporate Income Tax Rate.

Missouri Income Tax Rate And Brackets H R Block

State Tax Updates In 2021 Tax Executive

Tax Withholding For Pensions And Social Security Sensible Money

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Will Mississippi Join The No Income Tax Club

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Income Tax Ms Tax Calculator Community Tax

State Income Tax Rates Highest Lowest 2021 Changes

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Tax H R Block

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

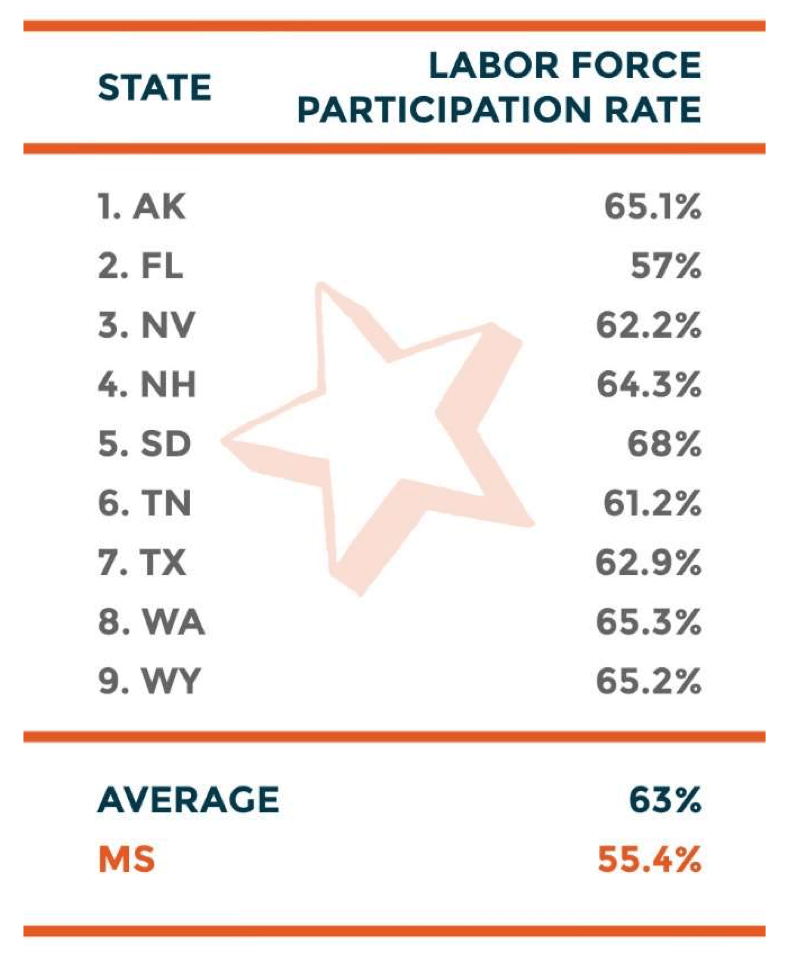

The Economies Of Income Tax Free States

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More